News

THE OIL MARKET HAS TURNED THE CORNER

July 2016, By Jim McAlister, Sr.

This report is a follow up to the McAlister Investment Real Estate's January 2016 report "Impact of 2015 Oil and Gas Price Drop on Houston Real Estate". Click here to read the January 2016 McAlister Oil Report.

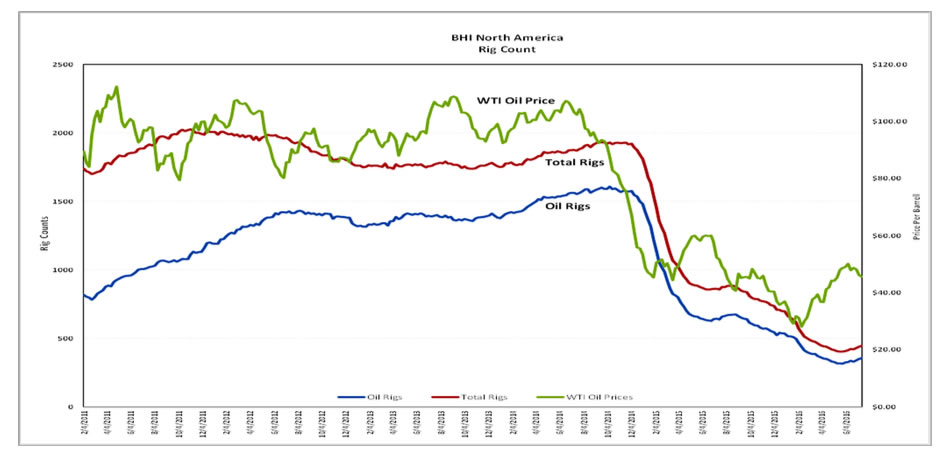

In the January 2016 report, McAlister Investment predicted that rig count and U.S. production would turn positive in mid-2016 or early 2017, signaling a bottom to the oil market decline. This report will elaborate on the forecast, its accuracy and the conclusions discussed in the January McAlister Investment Report.

This report updates information, articles, reports, and data through July 2016 and is a complement to the details presented in the January 2016 presentation.

The conclusions as of July 2016 are very clear. The oil market is trying to balance and the U.S. Oil & Gas industry is at the beginning of a sustainable recovery due to the rising but still volatile price of crude. This will have a large impact on the resurgence of Texas job growth and specifically growth within the Texas oil and gas job sector. With the return of steady job growth in the oil and gas sector of Texas and Houston, we will see a much stronger housing market and real estate growth activity.

While long term demand and consumption will continue to increase due to the growing global population, there are significant uncertainties for the short term that will add volatility in crude oil prices. There are several factors that could create downward pressure on oil prices. There is increased global supply from rising exports from Iran, the unknown impact of Great Britain leaving the EU following the Brexit vote and new drilling in the US that creates even more crude oil supply cumulatively leading to concerns about higher levels of crude and refined product inventories.

As of June 2016, the global supply of crude rose by 600,000 barrels to 96 mb/day. During that same period, OPEC‘s crude supply rose by 400,000 b/d while global demand is only increasing slowly.

Following 18+ months of decline in rig counts, U.S. production has also declined in 2016. There have been serious supply outages from geopolitical issues (Nigeria, Venezuela) and natural disasters (Canada wildfires). However, in other non- OPEC countries such as China, Mexico, and Columbia supply has moderately increased.

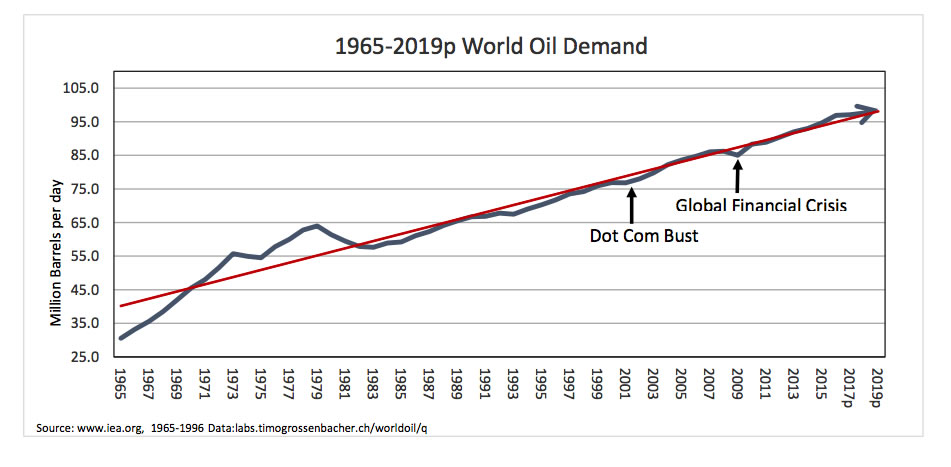

Global demand for oil has increased steadily for the last 30 years [see chart below] with the exception of 2001 (global currency crises and Dot-com bust) and 2009 (Global Financial Crisis) and should continue to do so on a steady trajectory. As global demand increases and closes the gap on global production, oil prices will inevitably increase.

However, during this period of balancing supply and demand of oil, it is reasonable to expect short term pricing volatility. Any increase in the price of oil is likely to be followed by flurried, but limited, increased oil production from new economically viable wells. This quickly causes an increase in supply, and resulting oil inventories, and the price of oil to moderate. Oil production then slows while demand continues its slow and steady increase and oil prices then recover. Then the cycle repeats. The economics of shale oil drilling has dramatically improved since 2014 and the price of oil is likely to bounce within a range of $40 to $50/bbl as the oil market find’s its footing on the evolving economically acceptable cost of production. Wells with high cost of production will remain quiet, while those oil fields and wells with lower and a more competitive cost of production find their profitable niche in the market.

The research department of Raymond James has raised its crude price expectations for 2017 from $60/bbl to $80/bbl. U.S. oil production was down 194,000 bbl/d for week ending July 1st. This will put overall U.S. output down to 8.4 million b/day.

Full Report

Please click here to read full report and find key points derived from various publications to support the above conclusions.

****

The conclusion of this report is that the oil market seems to be balancing and should do so in the next 8 to 12 months. Oil prices are poised to reach up to $60 /bbl by the end of 2016 and $70/bbl in 2017.

McAlister Investment Real Estate feels that the growing Oil and Gas E&P programs will create jobs in Texas and Houston. McAlister Investment will send out reports containing current information to its partners and friends monthly to help stay up to date on the oil field recovery and the employment growth that will have a strong impact on Texas real estate values and activity.

Please feel free to visit our website at www.mcalsiterinv.com for additional information on our company.

Jim McAlister, Sr.

DOWNLOAD FULL REPORT